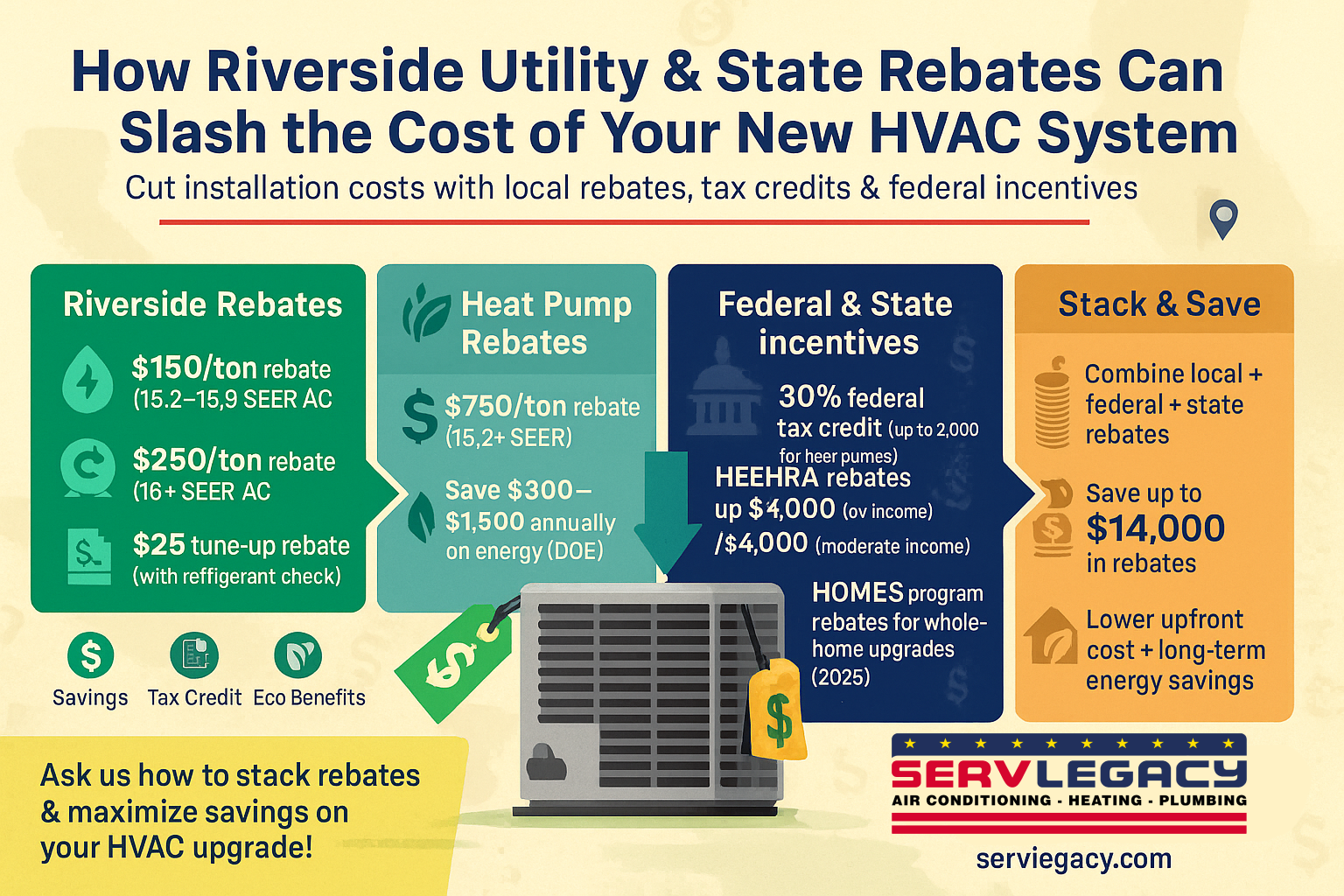

How Riverside Utility & State Rebates Can Slash the Cost of Your New HVAC System

A heating and air conditioning system is one of a homeowner’s biggest investments. Installation and replacement can cost from $5,000 to over $20,000 for high-efficiency equipment. Fortunately, utility and state rebates and federal tax credits are available. If you’re eligible for one of these programs, you can save thousands of dollars on a qualifying AC unit, furnace, or heat pump.

Riverside Public Utilities Rebates for Cooling Upgrades

The City of Riverside offers the Residential Heating and Cooling Rebate Program. It is available to electric customers who purchase and install an energy-efficient air conditioner or heat pump.

Both packaged units and split systems are included. However, for you to qualify for a rebate on a split system, the condenser and evaporator coil must be replaced at the same time. They must also match. The Air-Conditioning, Heating, and Refrigeration Institute (AHRI) maintains a listing of model numbers; if both units are listed in combination on the AHRI Directory, you can receive a rebate under the public benefit program.

Equipment must also meet specific efficiency requirements, as defined by a unit’s Seasonal Energy Efficiency Ratio (SEER). Here’s a look at what you can save:

- $150 rebate per ton for a 15.2—15.9 SEER AC unit.

- $250 rebate per ton for a 16+ SEER AC unit.

Riverside’s rebate program also includes $25 for an HVAC tune-up, provided that a refrigerant level check is included.

What You Can Save with Heat Pump Rebates in Riverside

You can receive a rebate of $750 (per ton) for a 15.2+ SEER electric heat pump air conditioner. Heat pumps are extremely efficient and provide both heating and cooling. They cost more than traditional AC systems, but can lower utility costs. However, a heat pump doesn’t work as well in temperatures below freezing.

The best system for your home depends on the local climate. To help you understand more about how a heat pump can help you save, let’s look at how it works. While a furnace generates heat using fuel or electricity, a heat pump instead transfers heat from outside to warm up your home (even in relatively chilly weather); reversing the refrigerant flow allows it to cool the space. It contains indoor and outdoor units like a traditional system.

According to the U.S. Department of Energy (DOE), an air-source heat pump can save you anywhere from $300 to $1,500 annually, depending on the model and the climate where you live.

Click on the link to learn more about Riverside’s Residential Heating and Cooling Rebate Program.

Federal Tax Credits and California Home Electrification Rebates (HEEHRA)

Aside from local incentives, federal and state programs are available. Signed into law in 2022, the Inflation Reduction Act (IRA) introduced two home rebate programs to help people save energy, make energy-efficient upgrades more affordable, and create jobs. It also added the following incentives to achieve these goals:

Tax Credits

The federal government offers a tax credit equal to 30% of installation costs. It’s available if you purchase products at the highest efficiency tier. You can qualify for a credit of up to $600 for a qualifying air conditioner and up to $2,000 for a qualifying heat pump.

The Energy Efficient Home Improvement Credit covers up to 30% of the cost of an energy upgrade and 10% of the cost of equipment. It is capped at $1,200 per year.

Meanwhile, Tax Section 25D, Residential Energy Efficient Property, currently provides a geothermal heat pump tax credit equal to 30% of the installation cost. Depending on your income, you can receive a rebate up to $8,000 for an all-electric system.

HVAC Rebates

California received $590 million from the DOE to support home energy rebates. Statewide, income-qualifying residents can receive rebates under the Home Electrification and Appliance Rebates (HEEHRA) and Home Electrification and Appliance Rebates (HOMES) programs:

- HEEHRA: Funded by the IRA, HEEHRA rebates are income-dependent; eligibility is determined by your Area Median Income (AMI). A low-income household (≤80% AMI) can receive a rebate of up to $8,000, and a moderate-income household (80% to 150% AMI) can receive up to $4,000 for a heat pump. Available for multi-family homes (and single-family homes when funding allows), these rebates are provided through TECH Clean California contractors, who perform installations, guide you through the rebate process, and ensure all requirements are met.

- HOMES: Available for whole-home energy upgrades, HOMES rebates will be available through funds awarded to California by the DOE in January 2025. These include funding for the Equitable Building Decarbonization Program for low- and moderate-income households and a Pay for Performance Program solely based on measured energy savings.

In addition, you may also qualify for utility HVAC rebates from your local electric or gas company.

Stacking Local and Federal Incentives for Maximum Savings

If you qualify for a residential energy rebate, you can combine it with other incentives. State, utility, and equipment rebates can be layered with tax credits, grants, and loans. State regulations and the requirements of each program must be considered, as there are limitations. Stacking incentives is encouraged, but is not allowed if the total amount exceeds the project cost.

Check with the state, the program’s fine print, and with your tax professional to ensure the application and/or filing process is done correctly.

Qualifying Products and Documentation for Rebates

Low-to-moderate income multifamily households can qualify for HEEHRA rebates for the following systems:

- Two-Speed Heat Pumps: $7,500

- Variable-Speed Heat Pumps: $8,000

- Heat Pump Water Heater (Electric to Electric): $700

- Electrical Load Service Center (Electric Panel): $4,000

- Electric Wiring: $2,500

- Electric Stove, Cooktop, Range, or Oven: $840

- Heat Pump Clothes Dryer: $840

You can combine rebates up to a maximum of $14,000.

During the application process, the following documents may be required:

- Tax forms (1040, W-2, 1099, etc.)

- Social security/retirement benefits

- Business income/rental income

- Pensions, retirement, and annuities

- Unemployment benefits/disability insurance

- Veteran’s benefits

- Government assistance

You’ll also need to submit information on Supplemental Security Income (SSI), Medi-Cal Assistance, and other programs you receive benefits from.

How to Apply for Rebates and Meet Program Requirements

If you’re eligible for a rebate, you must submit the required documents to get it. Applications are sent via HEEHRA Eligibility Express, and income verification is the first step. Once you verify your household meets income criteria (based on your location’s AMI), select a qualifying model, and complete the installation, you can submit your documents.

The same TECH Clean California-certified contractor who provides a project quote and performs the installation helps submit documents for your application. They also reserve the rebate for you. Approvals are usually emailed within three days, and your contractor will keep you updated on the status of your rebate reservation.

Choosing a Contractor Who Helps Manage the Rebate Process

To qualify for a rebate, you must work with a TECH-certified and HEEHRA-trained contractor. You can search for professionals using the directory at The Switch Is On. Once you find qualified prospects in your area:

- Verify the contractor is properly certified and trained.

- Check with the California Contractors State Licensing Board.

- Speak to the potential contractor about your project and rebates.

Long-Term Benefits of Rebated HVAC Upgrades: Efficiency, Comfort, and ROI

Rebates reduce the financial burden of an HVAC system installation or upgrade. They also promote a reduction in energy usage. By being able to afford a high-efficiency AC unit, furnace, or heat pump, you can not only lower your utility bills but also increase property value. An upgrade can help increase the selling price of property, not to mention improve tenant retention.

However, the benefits are more than financial. Your rebated high-efficiency air conditioner, furnace, or heat pump operates more cleanly, so it reduces your home’s carbon footprint. This helps contribute to fewer environmental emissions. Also, more advanced filtration leads to improved comfort and indoor air quality.

Seeing all these benefits starts with dramatic savings by combining HVAC rebates, tax credits, and other incentives.

Interested in an HVAC Upgrade, Rebates, or Tax Credits? Contact ServLegacy

At ServLegacy, our certified technicians have all your home air conditioning and heating needs covered. We work with you, from equipment recommendations and installations to helping you save upfront, to ensuring your home is energy efficient. Feel free to browse our informative articles for valuable insights. To request a consultation, contact ServLegacy today.